Saswat Patra; Neha Gupta

The study examines the relationship between volume and volatility in leading cryptocurrencies i.e. Bitcoin and Ethereum, within the framework of Mixture of Distribution Hypothesis (MDH). It accommodates structural shifts in the cryptocurrency prices and uses fat-tailed distributions. The results show that the MDH is rejected for both cryptocurrencies, and volume alone cannot explain the heteroskedasticity of returns; however, it acts as a significant predictor for volatility, especially when incorporating structural breaks in the model. Further, the forecasting performance improves when fat-tailed distributions, such as the skewed student’s t and Johnson’s Su distribution are used to model the innovations. Thus, volume holds important information in the crypto markets and can affect returns, thereby, raising concerns about market efficiency. Our results are robust across different periods, modelling approaches and forecasting horizons, and hold substantial implications for traders, market participants, regulators, and governments in designing effective policies.

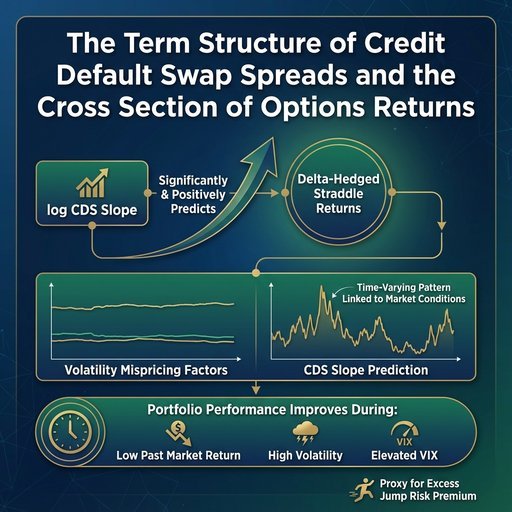

Hao Zhang, Yukun Shi, Dun Han, Pei Liu, Yaofei Xu

This paper, using the natural logarithmic form credit default swap (log CDS) slope, examines the variation in cross‐sectional 1‐month ATM delta‐hedged straddle returns. Our analysis reveals that the log CDS slope significantly and positively predicts these returns, even when accounting for several key volatility mispricing factors. Further investigation shows that this predictive relationship exhibits a strong time‐varying pattern, closely linked to market conditions. In contrast, the relationship between notable volatility mispricing factors and straddle returns remains relatively stable over time. Constructing a long‐short quintile portfolio on straddle options confirms that trading performance improves when the past 12‐month market return is at a historically lower level, market volatility is at a historically higher level, and the VIX is elevated. Log CDS slope, as a proxy for excess jump risk premium, significantly predicts delta‐hedged option returns during periods of high volatility.

Sami Ben Jabeur, Yassine Bakkar, Oguzhan Cepni

We investigate the impact of global common volatility and geopolitical risks on clean energy prices. Our study utilizes daily data from January 1, 2001, to March 18, 2024. Using a new framework based on explainable artificial intelligence (XAI) methods, our findings demonstrate that the COVOL index outperforms the geopolitical risk index in accurately predicting clean energy prices. Furthermore, the Extreme Trees algorithm shows superior performance compared to traditional regression techniques. Our findings indicate that XAI improves transparency, thereby making a substantial contribution to agile decision-making in predicting clean energy prices. Practitioners, including investors and portfolio managers, can enhance investment decisions and manage systemic risks by incorporating COVOL into their risk assessment and asset allocation models.

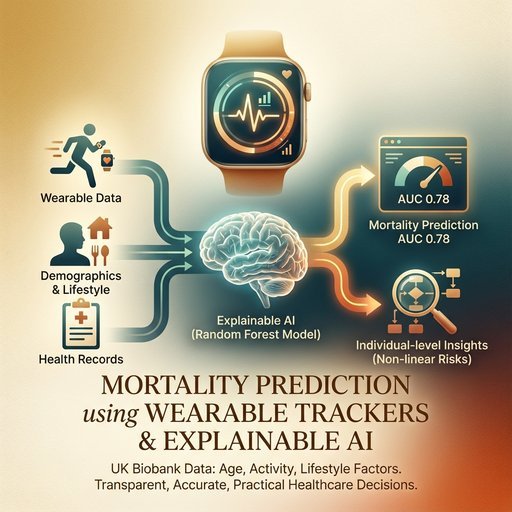

Byron Graham, Mark Farrell

Mortality prediction plays a crucial role in healthcare by supporting informed decision-making for both public and personal health management. This study uses novel data sources such as wearable activity tracking devices, combined with explainable artificial intelligence methods, to enhance the accuracy and interpretability of mortality predictions. By using data from the UK Biobank—specifically wrist-worn accelerometer data, hospital records, and various demographic and lifestyle factors, and health-related factors—this research uncovers new insights into the predictors of mortality. Explainable artificial intelligence techniques are employed to make the models’ predictions more transparent and understandable, thereby improving their practical applications in healthcare decisions. Our analysis shows that random forest models achieve the highest prediction accuracy, with an area under the curve score of 0.78. Key predictors of mortality include age, physical activity levels captured by accelerometers, and other health and lifestyle factors. The study also identifies non-linear relationships between these predictors and mortality, and provides detailed explanations for individual-level predictions, offering deeper insights into risk factors.